Debtors who borrowed under $5,000 were nearly twice as likely to default on their student loans as those who borrowed over $100,000. “The fact is that default is highest among those with the smallest student debts,” wrote Susan M. Dynarski, the report’s author. “Of those borrowing under $5,000 for college, 34 percent end up in default. This default rate actually drops as borrowing increases. For those borrowing more than $100,000, the default rate is 18 percent. Among graduate borrowers — who tend to have the largest debts — just seven percent default on their loans.”

The reason, Dynarski wrote, is because the higher borrowing is associated with career paths that will yield higher earning, and thus, higher potential to repay the debt. “These borrowers spent many years in college, and so racked up many years of debt. But they built up a lot of human capital during their college careers (and brought a lot with them in the first place), which pays off in the labor market,” she reasoned.

Conversely, she wrote, “The small borrowers tend to be those who spent just a year or two at a for-profit or community college. They spent little time in college, and so racked up little debt. But they also built up little human capital (and had low stocks to begin with), and so do relatively poorly in the labor market.”

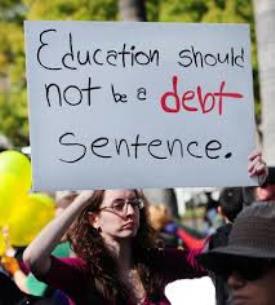

But Sara Goldrick-Rab, a professor of education policy studies and sociology at the University of Wisconsin–Madison, wrote in a rebuttal blog that therein lies the key issue for many of those with the lowest amounts borrowed ― it is not that their salaries are simply lower than those who take on more debt, it is that the failure to obtain postsecondary credentials keeps them in a pattern of lower earning potential and handicaps their future children in addition to themselves.

“Over time we have eroded grant support to the poor and saddled them with loans,” she wrote. “They now face tremendous, predictable risk [of trying, but not completing college], and that’s a problem we can and should deal with.”

Dynarski wrote that lengthening the repayment timeframe will help solve the problem, but Goldrick-Rab countered, “Student debt is a serious problem but it is ultimately an educational policy concern and cannot simply be treated as a finance problem to be solved with the usual finance tweaks,” saying free college proposals, not tweaking loan repayment options, is the key.