Nearly 70 percent of all graduating college seniors in 2012 had a student loan debt and their average debt was $29,400, according to a new report from The Project on Student Debt at the Institute for College Access and Success. (TICAS). College graduates student loan debt increased from 2011 to 2012 by 10.5 percent, an increase from $26,600 in 2011 to $29,400 in 2012.

Despite the sharp decline in private education lending, one-fifth of student graduate debt was in private loans, which yield more risks, fewer protections and repayment options and are often more costly compared to safer federal loans. The average student debt from federal and private loans combined increased on average 6 percent per year from 2008 to 2012.

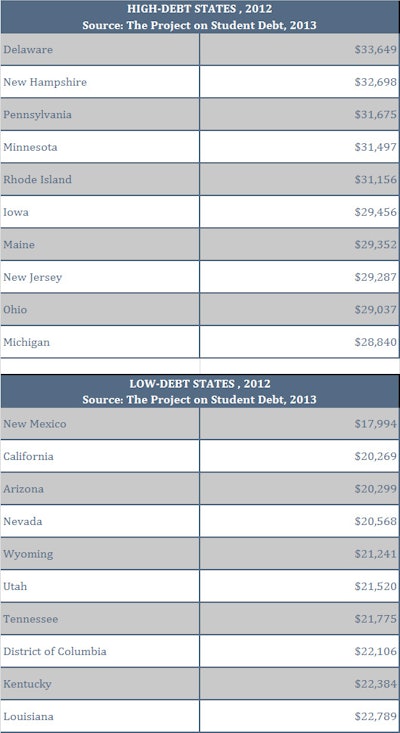

A report released in December, Student Debt and the Class of 2012 reports a detailed analysis of significant differences in student debt across states and colleges around the country. For example, students attending colleges in Delaware have twice as much debt compared to New Mexico, and in five states student debts reached an average of over $30,000.

As unemployment continues to be high, young college graduates are often the first to be affected. In 2012, 7.7 percent of 2012 college graduates were unemployed, and over 18 percent of graduates were either working part-time positions, unemployed or decided to stop their job hunt. Despite these grim statistics, having a college degree still awards more workforce opportunities as 17.9 percent of high school graduates with no college were unemployed in 2012.

“Despite discouraging headlines, a college degree remains the best route to finding a job in this tight market. But students and families need to know that debt levels can vary widely from college to college,” said TICAS president Lauren Asher. “If you need to borrow to get through school, federal student loans are the safest way to borrow. Whatever you earn, income-driven plans like Pay As You Earn can help keep federal loan payments manageable.”

State highs and lows: On average student graduation debt ranged from $18,000 to $33,650 across all states in America. Northeast and Midwest states remained the high-debt states, with Delaware (average $33,649) ranking the highest. Minnesota, New Hampshire, Pennsylvania and Rhode Island all have student loan averages of over $30,000. States in the West and South had the lowest debts, including New Mexico (the lowest), Arizona, California, Nevada and Wyoming.